Infinite Banking Trend

The truth of the infinite banking social media trend.

Any 30 second “secrets of the rich” Tik-Tok/Instagram video should raise more flags than a NASCAR race. Unfortunately, many are so eager to want to be in on the easy and secretive path to riches that they are more susceptible to such content and often do little to challenge their initial understanding of such ideas. So lets challenge them together!

Using a life insurance policy as a tax free vehicle for interest accumulation and source of funding is not a new concept. What is new is the recent social media content machine turning its attention towards such an idea and warping the details for maximum outrage.

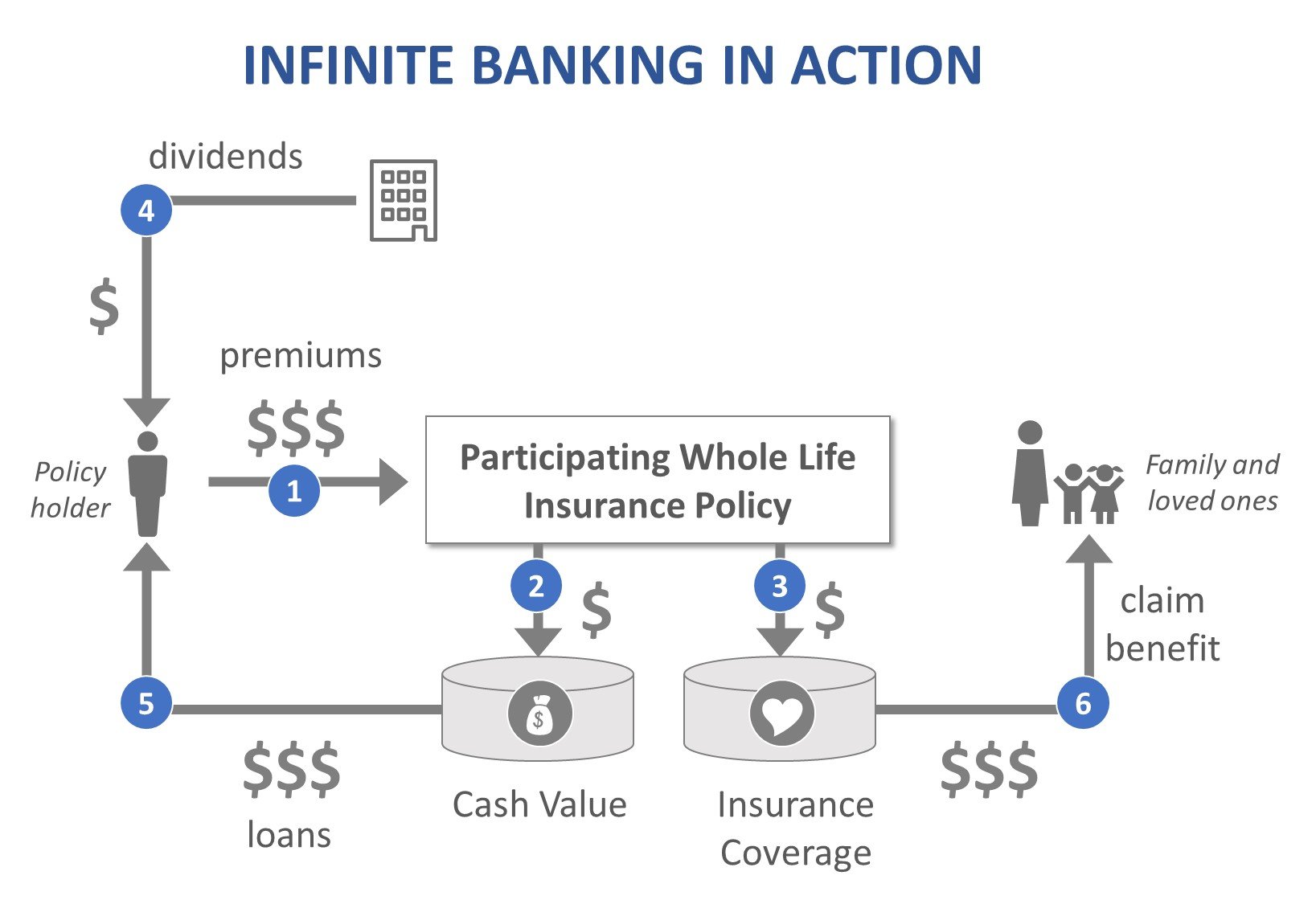

The first detail that needs clearing up is how a policy can accumulate enough funds to be able to be used as a cash source and the resulting consequences doing so can have within the policy. Premiums contributed to a life insurance policy that builds cash value must first clear the costs of insurance associated with that coverage. On average, cash accumulation in life insurance does not begin until the 3rd to 5th year of premiums. In addition, within the first 15-20 years there are typically cash surrender charges that are deducted from your cash value, incentivizing the owner not to immediately access any funds. Once all of these charges and fees are surpassed, the excess amount can then go into the cash account to receive an interest rate. I explain this to illustrate that cash value accumulation within a life insurance policy takes a significant amount of time to build value worth withdrawing from. The only way to shorten the time that it takes to do this is to massively over-fund the policy in relation to its costs. As a general rule of thumb, most advisors recommend placing about 10% of your annual income into the policy itself, worth usually about a $500 monthly premium in the DMV region. Even after such large contributions, I personally do not recommend attempting to access this money until after the 20th year. Now in my practice I will often be tasked with finding a sweet spot of coverage and cash growth for clients for a premium that they can afford. To do this however, we have to sacrifice either the coverage or the cash growth features of the policy, as trying to maximize both is just too expensive for the average consumer.

Despite what you might hear on Tik Tok, Newton’s third law of motion still applies to your life insurance policy. The money that your policy accrues is not only a crucial part of the consideration you must give up to be covered, but also a integral piece to this actually being a profit generating venture for the issuing company. Therefore, the action of withdrawing or loaning cash value out will have a opposite and equal affect on your policy. This occurs in two ways; One, you take your cash out as a permanent withdraw from the policy. The company will give you the amount you request and permanently reduce your death benefit in proportion to the amount you removed. Two, you loan out the cash to yourself, maintain the full death benefit but also promise to repay the loaned amount back. You may decide to not pay the balance back, but you will pay a annual loan interest rate on the balance due, with the full loan balance then being deducted from your death benefit at the time of a claim.

There is NO way for you to take out any cash value in any policy, while maintaining the same death benefit, cash value balance, or not generating a annual interest rate due on that loan.

Now, none of these facts take away from the great benefits over-funding a indexed universal life policy can have, including the access to a tax free income stream. These products can be planned and over-funded in such a way that there are ways to even nullify any loan interest rates due to interest credited being greater than both those rates and the rising cost of insurance. If the client wishes to avoid loan interest rates altogether, there are other designs that will allow the cash value to be taken right off the top of the death benefit, while maintaining the ability to add back to the death benefit at a time of your choosing, with no loan or policy fees due. A highly proficient advisor can accomplish such a task, but of course this type of planning can not be accurately described in a 30 second video.

Every ethical financial advisor/professional should be up in arms across the country and creating their own content to combat these dangerous misconceptions before our industry becomes distrusted as a whole. If upon reading this you realize you have entered into a contract that you did not fully understand or are considering doing so, please send us a contact request or email and we will gladly help where we can.